New Irs Tax Brackets 2025 Vs 2025 - Tax rates for the 2025 year of assessment Just One Lap, Along with higher standard deduction amounts, the irs has adjusted the income tax brackets from the 2025 tax year. In addition to adjusting the tax brackets, the irs also announced changes to the standard deductions for 2025. There are seven federal income tax rates and brackets in 2023 and 2025:

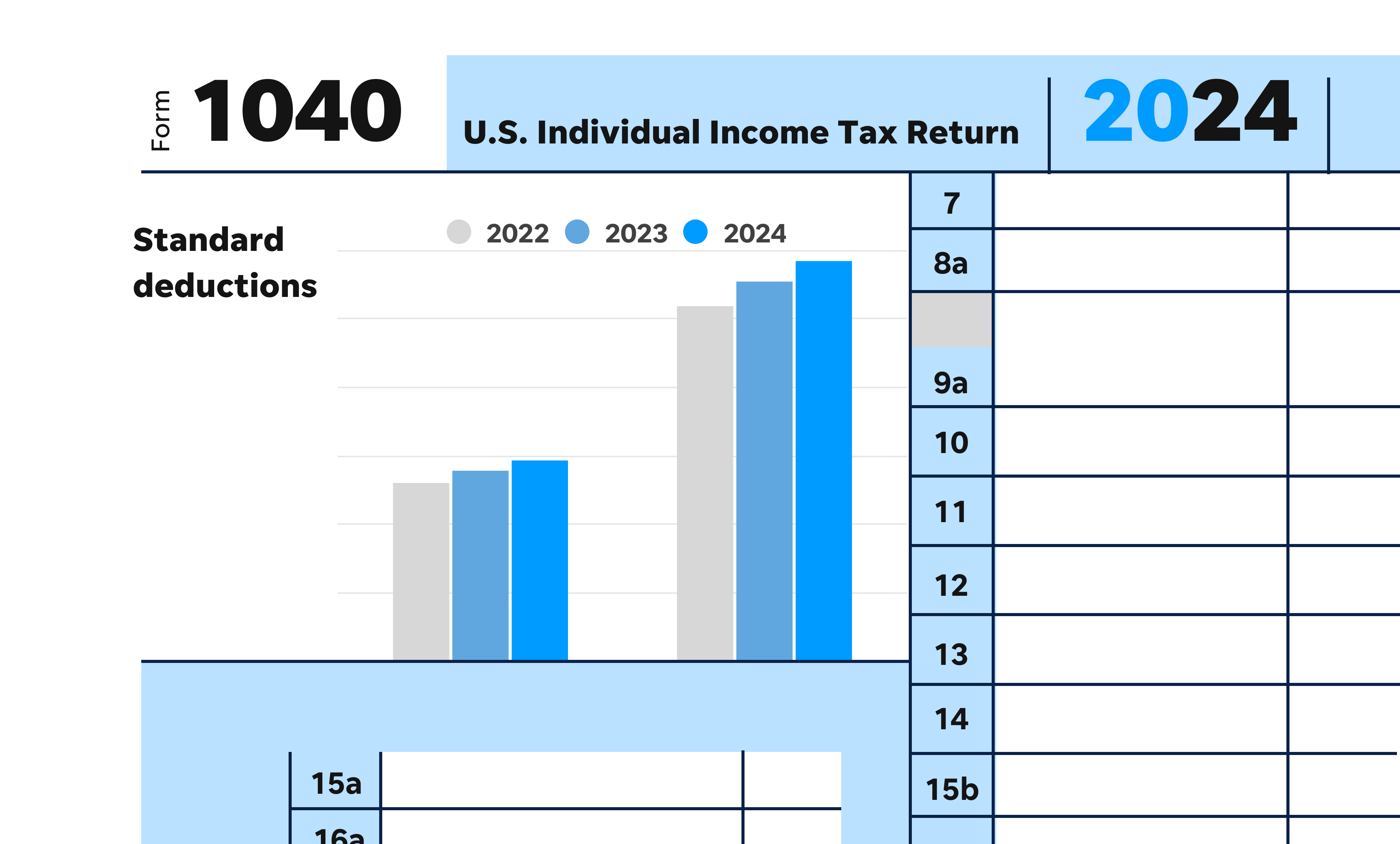

Tax rates for the 2025 year of assessment Just One Lap, Along with higher standard deduction amounts, the irs has adjusted the income tax brackets from the 2025 tax year. In addition to adjusting the tax brackets, the irs also announced changes to the standard deductions for 2025.

Irs 2025 Standard Deductions And Tax Brackets Danit Elenore, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The standard deduction and tax brackets were set 7%.

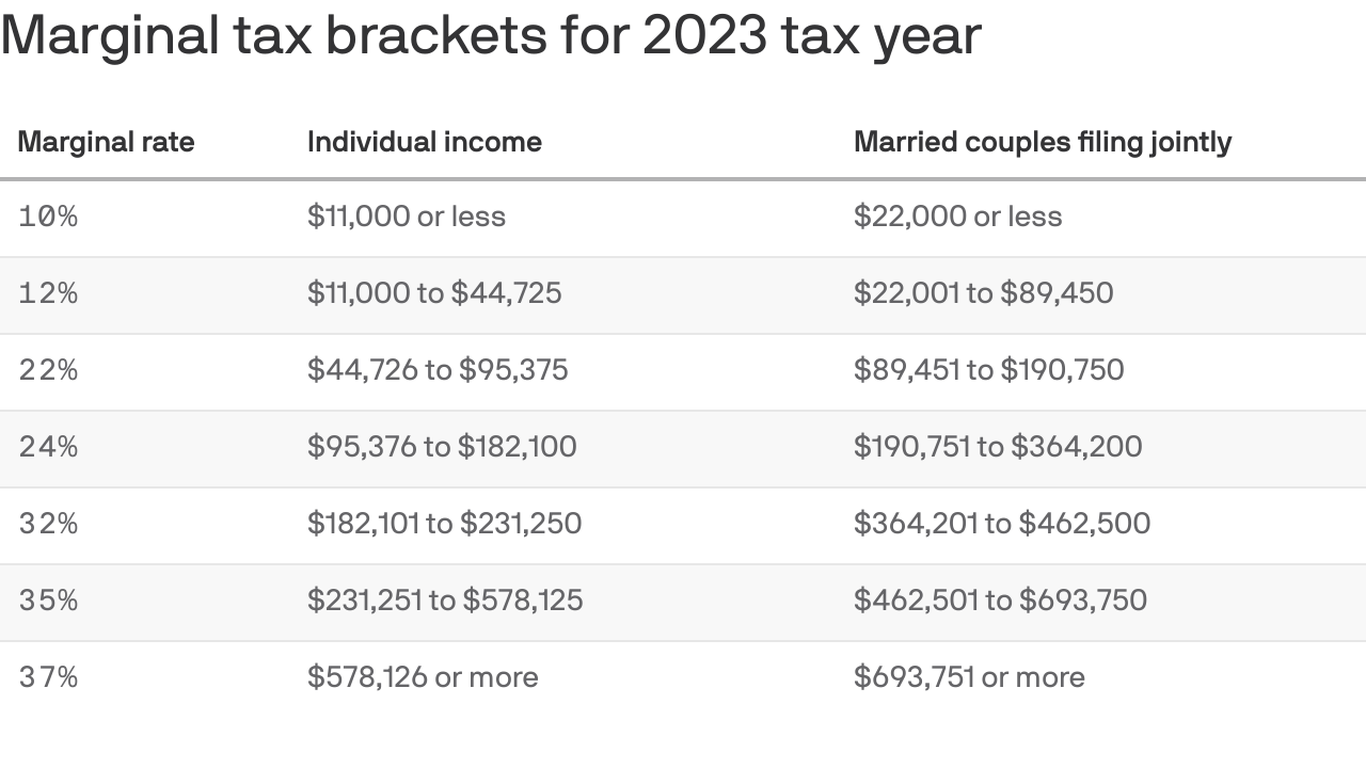

How 2025 irs tax brackets compare to 2023: The irs announced the higher limits in november, which.

Here are the federal tax brackets for 2023 Axios NEWS DEMO, The irs has announced new income tax brackets for 2025. See the tax rates for the 2025 tax year.

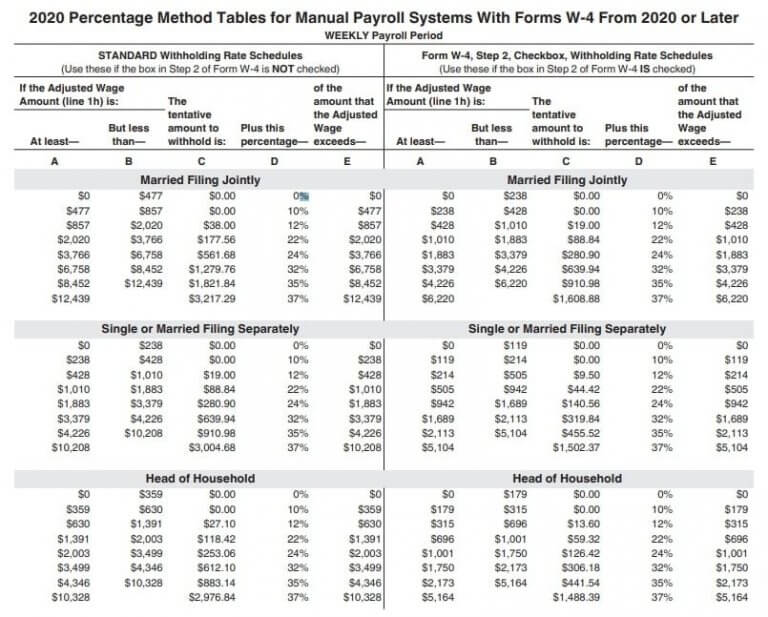

Maximize Your Paycheck Understanding FICA Tax in 2025, The irs issued a press release describing the 2025 tax year adjustments that will apply to income tax. Along with higher standard deduction amounts, the irs has adjusted the income tax brackets from the 2025 tax year.

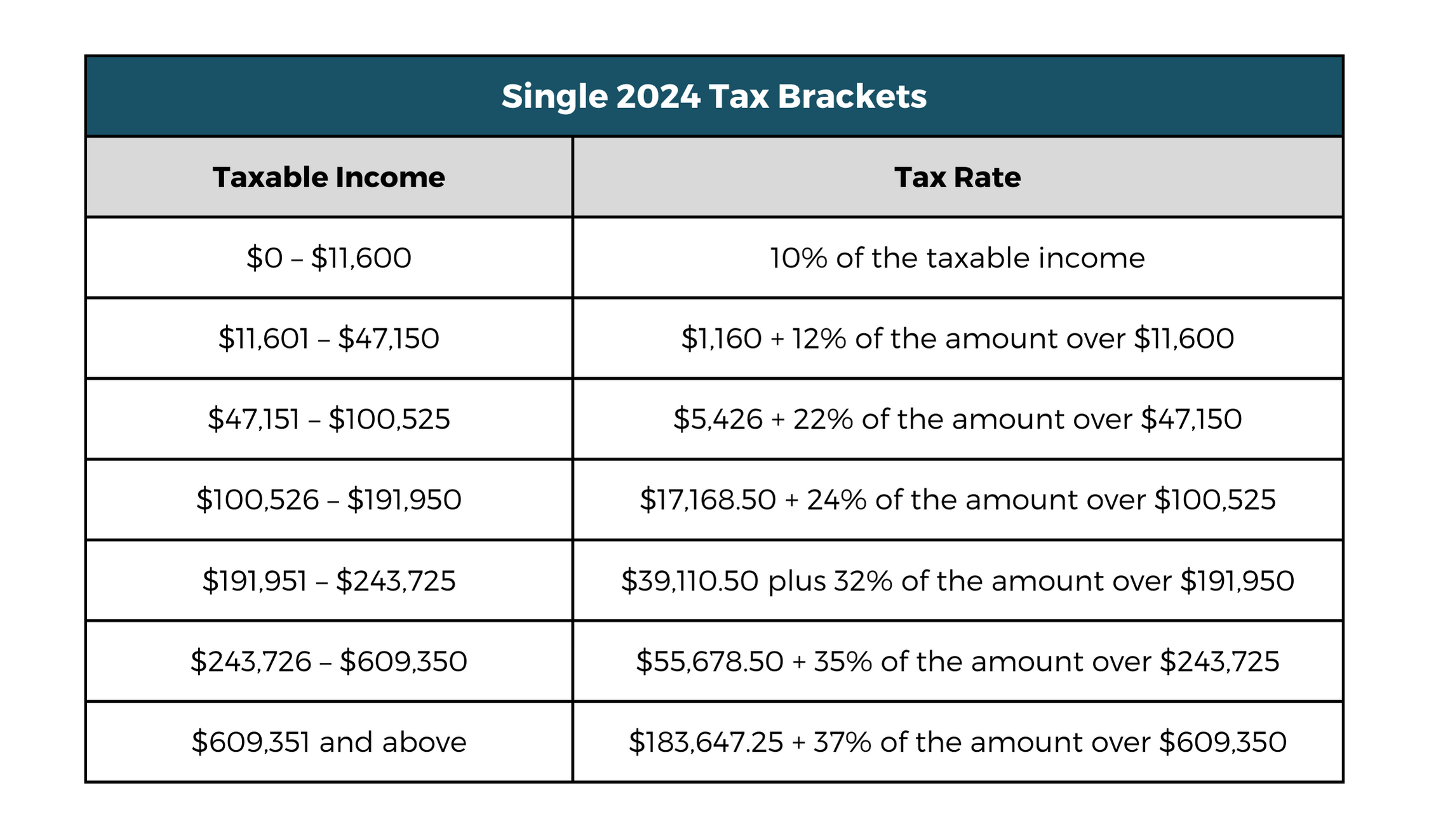

Irs Tax Brackets 2025 Single Sukey Engracia, November 10, 2023 / 4:59 pm est / moneywatch. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Tax Brackets 2025 What I Need To Know. Jinny Lurline, New irs tax brackets take effect in 2025, meaning your paycheck could be bigger next year. The rebound in 2025's average refund size is due to the irs' adjustment of many tax provisions for inflation.

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The income you can earn per each bracket has been raised a fairly significant amount, on average a little. Along with higher standard deduction amounts, the irs has adjusted the income tax brackets from the 2025 tax year.

IRS announces new tax brackets for 2025. What does that mean for you?, The irs announced the higher limits in november, which. See the tax rates for the 2025 tax year.

New Federal Tax Brackets for 2023, The adjustment of irs provisions for inflation for the 2023 tax year, including increases in the standard deduction and tax brackets by about 7%, has contributed to the larger. See the tax rates for the 2025 tax year.

The 2023 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: